In the first installment of The State of Australian Home Renovations series, I presented to you data gathered by Roy Morgan Research

If you recall, the research findings revealed that there’s been a 5% increase in homeowner renovation activity in the country for the past 4 years. The research calculated that close to 8.4 million out of the 13.6 million homeowners in the country did renovation work on their property.

We closed our discussion by asking this question:

What motivates homeowners to renovate?

In this installment, I’ll be presenting and discussing the data published by Houzz Australia, a visual platform for home renovation and design that allows homeowners and professionals to interact in an online community.

The research entitled Houzz & Home – Australia, was compiled in Q2 2016 and was published in August of that same year. The research provides an overview of the home renovation activities done in 2015 and in early 2016. The data was gathered based on reports made by homeowners within the Houzz Australia community.

Let’s get started!

What did Australians do to their homes?

Homeowner data from 2015 revealed that the following home-related activities were undertaken:

It was also revealed that homeowners planned to undertake the following activities in 2016:

As you can see, more homeowners planned to renovate in 2016. In the first installment of this series, we mentioned that this was indeed the case as more homeowners did renovate their homes, with the majority of them undertaking minor repair or alterations.

What do Australians prefer: renovating or buying?

To put things in context, ‘buying’ means finding that ‘perfect’ home and not doing renovations after the purchase. That’s in line with the thought that the perfect home already suits the needs of its occupants. In contrast, ‘renovating’ involves renovating the primary home to suit the needs of its occupants. Results revealed that more homeowners preferred to renovate rather than to buy. But why?

Homeowners who chose to renovate than to buy the perfect home were concentrated in the 25 to 34-year age range. The primary reason stated was that renovation is more affordable.

I find this interesting because the sense of affordability created by renovation is actually aligned to a long-term result: increased home equity. Renovation is a strategy that allows homeowners to manufacture equity on their property. That’s regardless if the homeowner intends to sell the property or stay in it long-term.

What motivated home renovations?

2015 was considered as a sluggish time for the renovation sector. In the first installment, we mentioned that there had been a consistent renovation activity in NSW but it seemed to have stalled in other states. For homeowners who renovated in 2015, they cited the following reasons for doing so:

The motivations stated by homeowners in this research are actually considered as the ‘market pains’ in the renovation sector. Lack of time, lack of finances, changes in lifestyle and family structure, lack of knowledge in renovation, and routine property upkeep are some of the factors contributing to homeowner indecision.

With the availability of the resources that initially were impediments to renovation, it made sense that these homeowners were finally able to renovate their homes.

How much did homeowners spend on renovation?

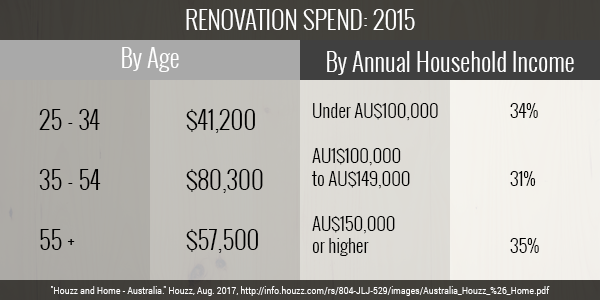

On average, the total expenditure reported by homeowners on Houzz was $68,300. Here’s how it’s broken down by age range and according to annual household income:

In terms of payment method, 78% of those who renovated utilised their savings or personal finances to fund their renovations. Other sources of funding as reported were cash from mortgage refinance, credit card, line of credit, and gift or inheritance.

What priority areas were renovated or added?

Data gathered in this section answers the question, ‘what do I want to renovate or add to my home?’ Here are the results:

In a renovator’s perspective, you might be wondering: will renovating these areas actually drive equity up for a property? How much equity will be added if you renovate a property’s kitchen, for example?

I’m saving a discussion about the relationship between equity and renovation for another time. But what this research reveals is that renovation is definitely being planned by homeowners. This is especially so for those whose homes were built between 1981 – 2000 and home with owner-reported values between $500,000 – $999,999.

Finally, as reflected on the research discussed in Part 1 of this series, 82% of those who renovated are homeowners living in detached, single-family dwellings.

In the next installment of this series, we’ll be looking at the role of property renovators and other professionals in the renovation sector when it comes to successful renovation.